Managing Corporate Financial Resources 3791613713

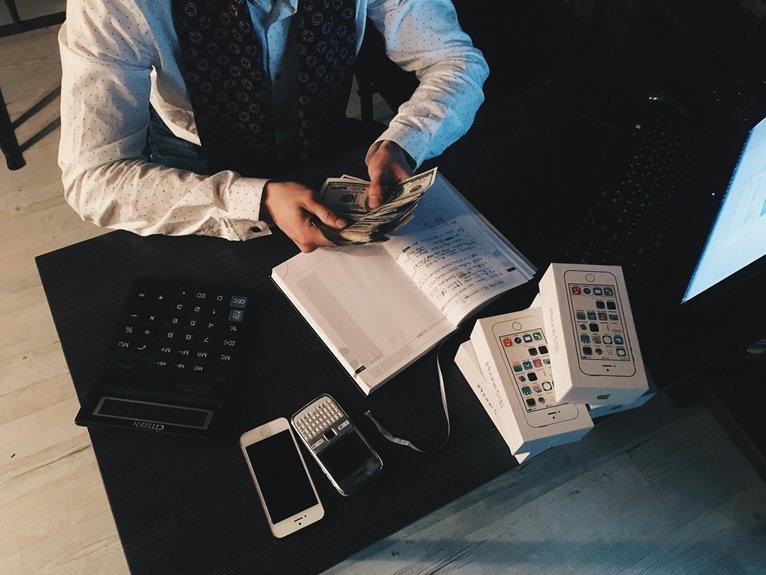

Managing corporate financial resources requires a systematic approach to ensure efficiency and growth. Organizations must prioritize projects that yield significant returns while maintaining a vigilant stance on cash flow. Strategic alignment of financial decisions with overarching goals is essential. The effectiveness of these strategies depends on the tools and metrics employed. Understanding the dynamics of resource management can illuminate paths to improvement and adaptability in an ever-changing market landscape. What specific methods can enhance this process?

Understanding Corporate Financial Resources

Corporate financial resources encompass the funds and assets that a company utilizes to support its operations and drive growth.

Effective corporate budgeting and financial forecasting are crucial in this context, as they ensure optimal allocation of resources.

Key Strategies for Effective Resource Management

Implementing effective resource management strategies is essential for optimizing financial performance and achieving long-term objectives.

Key strategies include precise budget allocation to ensure funds are directed toward high-impact projects, and proactive cash flow management to mitigate risks.

Tools and Techniques for Financial Decision-Making

Effective financial decision-making relies on a diverse array of tools and techniques that empower organizations to analyze data, forecast trends, and evaluate potential outcomes.

Financial forecasting models enable accurate predictions, while capital budgeting techniques facilitate optimal investment choices.

Together, these approaches enhance strategic planning, allowing businesses to allocate resources judiciously, adapt to market changes, and ultimately, pursue their financial aspirations with confidence.

Measuring Success in Financial Resource Management

How can organizations accurately assess the success of their financial resource management strategies?

By employing well-defined success metrics and performance indicators, organizations can gain insights into their financial health.

Key metrics such as return on investment, cost efficiency, and liquidity ratios provide a framework for evaluation.

This strategic approach enables organizations to identify strengths, weaknesses, and opportunities for improvement, fostering financial autonomy and growth.

Conclusion

In conclusion, managing corporate financial resources is akin to navigating a ship through turbulent waters; strategic foresight and precise adjustments are essential for successful passage. By prioritizing high-impact projects and employing effective cash flow management, organizations can align financial decisions with their long-term goals. Utilizing advanced analytical tools and clear success metrics enables companies to continuously assess their financial health, adapt to market fluctuations, and ultimately foster sustainable growth and operational efficiency.