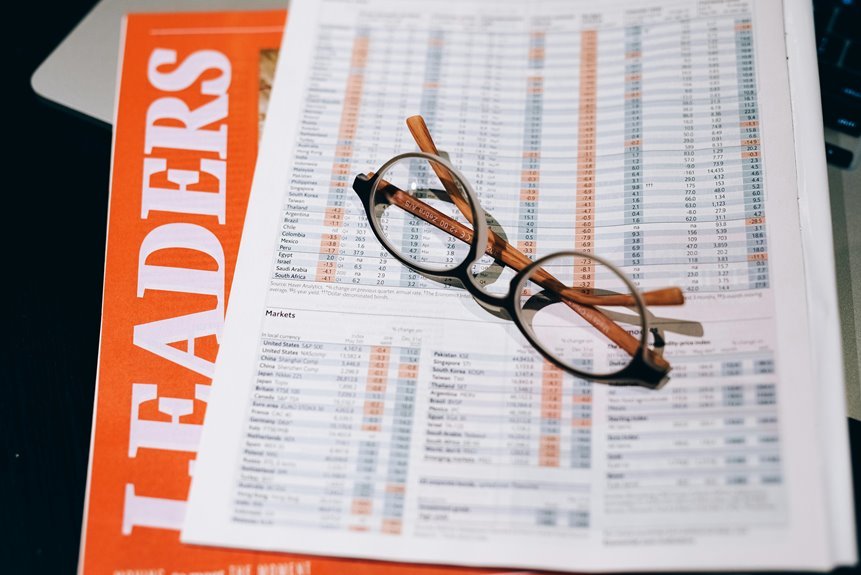

Corporate Finance Reporting for Leaders 3896679970

Corporate finance reporting serves as a fundamental pillar for leadership decision-making. Transparent financial statements provide insights into an organization’s fiscal health. By understanding key financial ratios, leaders can strategically assess risks and opportunities. Effective budgeting and forecasting further enhance this framework. As best practices in financial reporting evolve, the implications for compliance and stakeholder trust become increasingly significant. What strategies can leaders adopt to optimize these financial tools for sustainable growth?

Understanding Financial Statements

While many leaders may overlook the intricacies of financial statements, a thorough understanding of these documents is essential for informed decision-making.

Financial statement analysis provides insights into a company’s performance, while a balance sheet breakdown reveals its financial health.

Leaders must recognize the importance of these analyses to navigate strategic initiatives effectively, ensuring they make choices that promote organizational freedom and sustainability.

Key Financial Ratios for Leaders

How can leaders effectively gauge their organization’s financial performance?

By analyzing key financial ratios such as profitability ratios and liquidity ratios, leaders can gain insights into the company’s efficiency and financial health.

Profitability ratios reveal earnings relative to revenue, while liquidity ratios assess the organization’s ability to meet short-term obligations.

Together, these metrics empower leaders to make informed, strategic decisions for sustainable growth.

Budgeting and Forecasting Essentials

Effective financial performance evaluation through key ratios serves as a foundation for sound budgeting and forecasting.

Leaders must analyze budget variances to ensure alignment with strategic goals.

Accurate cash flow projections enable organizations to allocate resources efficiently and adapt to changing market conditions.

Best Practices for Effective Financial Reporting

To ensure that financial reporting serves its intended purpose, organizations must adopt best practices that enhance clarity and accuracy.

Implementing robust data visualization techniques is crucial, as it transforms complex financial data into intuitive formats.

Regularly updating financial reports and ensuring compliance with regulations further solidifies trust.

Conclusion

In conclusion, “Corporate Finance Reporting for Leaders” serves as a compass for executives navigating the complex financial landscape. By mastering financial statements, key ratios, and best practices, leaders can not only illuminate their organization’s financial health but also chart a course towards sustainable growth. This resource transforms financial reporting from a mere obligation into a strategic advantage, fostering resilience and trust among stakeholders while empowering informed decision-making in an ever-evolving marketplace.