Building Financial Resilience in Companies 3512882761

Building financial resilience in companies is a critical focus in today’s unpredictable economic landscape. Organizations must adopt proactive risk management strategies and embrace innovative solutions to safeguard their financial stability. By prioritizing effective cash flow management and flexible budgeting, businesses can better navigate uncertainties. The integration of financial technology further enhances operational efficiency. However, understanding the nuances of financial resilience raises important questions about the sustainability and adaptability of these practices. What strategies are most effective?

Understanding Financial Resilience

Understanding financial resilience involves recognizing a company’s capacity to withstand and adapt to economic challenges, ensuring its long-term sustainability.

A firm’s financial literacy plays a crucial role in managing cash flow effectively, enabling it to navigate uncertainties.

Key Strategies for Risk Management

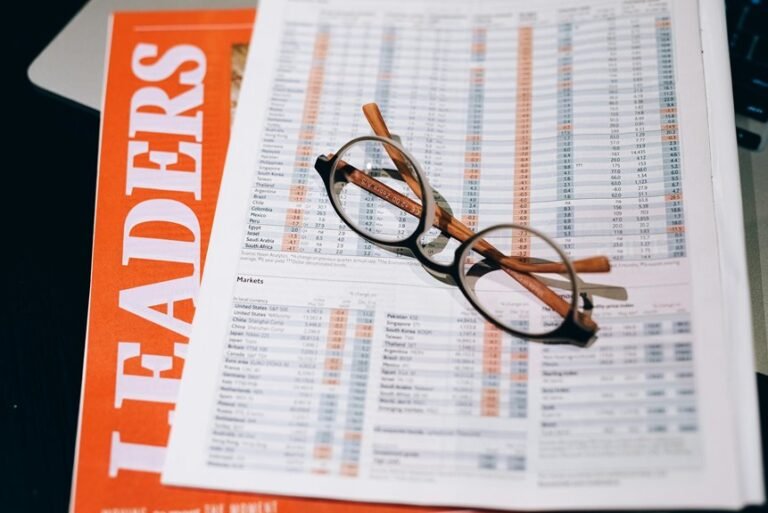

Building financial resilience requires a proactive approach to risk management, as companies face a variety of potential threats that can disrupt their operations and financial stability.

Effective risk assessment is crucial, enabling organizations to identify vulnerabilities.

Implementing targeted mitigation techniques allows for a structured response to these risks, fostering adaptability and ensuring long-term sustainability in an increasingly unpredictable business environment.

The Role of Innovation in Financial Stability

While many companies prioritize traditional financial strategies to maintain stability, innovation emerges as a critical component in fostering long-term financial resilience.

Embracing financial technology and implementing innovative solutions allow organizations to adapt swiftly to market changes. These advancements not only enhance operational efficiency but also enable better risk management, ultimately strengthening a company’s financial foundation and ensuring sustained growth in an evolving economic landscape.

Developing a Flexible Financial Strategy

A flexible financial strategy serves as a cornerstone for companies aiming to navigate the complexities of today’s dynamic market environment.

Effective management of cash flow and timely budget adjustments empower businesses to respond swiftly to unforeseen challenges.

Conclusion

In conclusion, fostering financial resilience is akin to navigating a ship through stormy seas; it requires a robust compass of strategic planning and adaptability. Companies that prioritize risk management, embrace innovation, and cultivate financial literacy position themselves not just to survive but to thrive in volatile markets. By establishing flexible financial strategies, organizations can ensure they remain buoyant, capitalizing on opportunities while effectively mitigating potential threats, ultimately securing their competitive advantage in an ever-evolving economic landscape.