Financial Risk Management for Businesses 3519383517

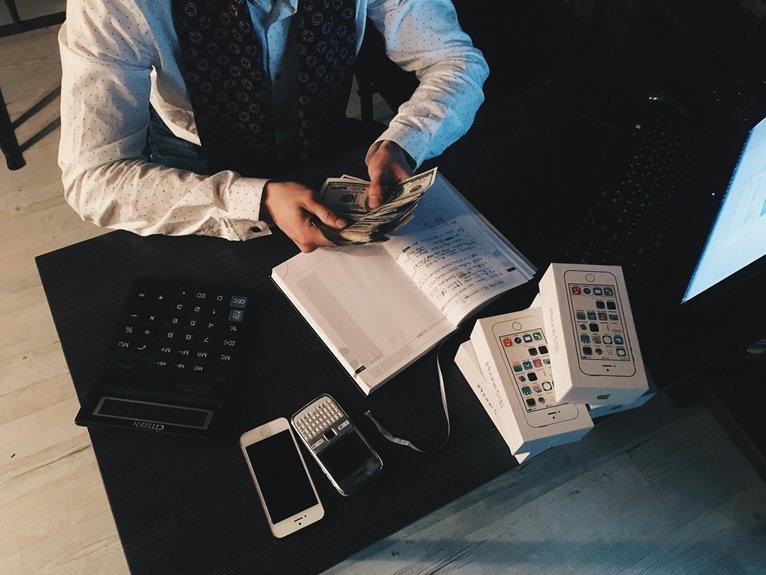

Financial risk management is essential for businesses aiming to maintain stability in turbulent environments. By identifying potential financial threats, organizations can assess their impact effectively. This analysis allows for strategic prioritization of risks and the allocation of resources accordingly. However, the choice of appropriate mitigation strategies, coupled with advanced tools, remains critical. Understanding these dynamics can reveal how businesses can enhance their resilience and align risk management with broader organizational objectives. What strategies emerge as most effective?

Identifying Financial Risks

Identifying financial risks is a critical process that requires a systematic approach to ensure comprehensive assessment.

Effective risk identification involves thorough risk categorization, enabling businesses to distinguish between various risk types.

By systematically analyzing potential threats, organizations can prioritize their focus, fostering a proactive stance.

This strategic methodology empowers decision-makers to navigate uncertainties, safeguarding their financial freedom while optimizing resource allocation for risk mitigation strategies.

Assessing the Impact of Risks

How can businesses effectively evaluate the potential consequences of financial risks?

Conducting a thorough risk assessment allows organizations to identify vulnerabilities while impact analysis quantifies the potential financial implications.

This strategic approach enables businesses to prioritize risks based on their severity, fostering informed decision-making.

Mitigation Strategies for Financial Risks

Evaluating the potential consequences of financial risks sets the stage for implementing effective mitigation strategies.

Organizations can employ risk transfer mechanisms, such as insurance, to shift exposure to external entities.

Additionally, robust contingency planning is essential, allowing businesses to navigate unforeseen challenges without significant disruption.

Tools and Technologies for Financial Risk Management

As businesses confront an increasingly complex financial landscape, leveraging advanced tools and technologies becomes critical for effective risk management.

Sophisticated risk assessment frameworks and robust analytics software empower organizations to quantify potential threats and evaluate exposure.

Conclusion

In the intricate tapestry of business, financial risk management serves as a vigilant sentinel, guarding against the tempestuous winds of uncertainty. By systematically identifying and assessing potential threats, organizations can weave robust mitigation strategies that fortify their foundations. Leveraging cutting-edge tools transforms risk into opportunity, allowing businesses to navigate toward prosperity with confidence. Ultimately, a proactive stance on financial risk not only preserves stability but also aligns seamlessly with the broader vision for enduring success in an ever-evolving landscape.